Over the next few weeks, I’m going to talk about a series of leadership paradoxes through real-life stories. These paradoxes are based on Dr. Dan Harrison’s work in leadership competencies. If you have done any leadership development, they will be familiar to you. This week we are focusing on being a better strategist.

Recently, I was working with client, an investment banker, who couldn’t understand why he wasn’t more successful with his company’s investments. He was well-trained, experienced, knowledgeable, and competent. He was extremely careful about analyzing risks, but seemed to miss out on opportunities that would have paid off extremely well for the organization and it’s customers.

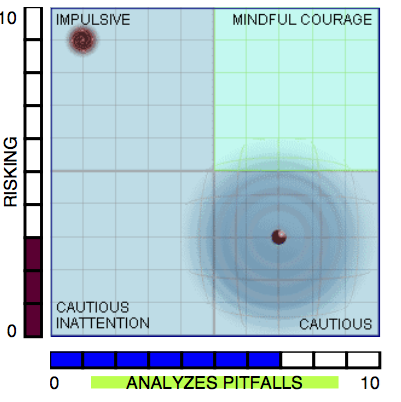

To get to the bottom of this case, I coached my client using the Harrison Assessment. We pinpointed the issue via his Strategic Paradox score. The Strategic Paradox measures two traits:

- Risking, which is how comfortable you feel with business ventures involving uncertainty

- Analyzing Pitfalls, which is how well you evaluate potential difficulties

When you score high on both traits, you are willing to take risks as well as able to identify and analyze problems that might arise if you take the risks. Generally speaking, an investment banker carefully analyzes risks to avoid investing in losing opportunities. My client scored high in Analyzing Pitfalls, but low in Risking. Although it would seem that this would be a good score for an investment banker, it was actually causing her to miss out on good, solid investment opportunities. Why would this be the case?

When you score high on both traits, you are willing to take risks as well as able to identify and analyze problems that might arise if you take the risks. Generally speaking, an investment banker carefully analyzes risks to avoid investing in losing opportunities. My client scored high in Analyzing Pitfalls, but low in Risking. Although it would seem that this would be a good score for an investment banker, it was actually causing her to miss out on good, solid investment opportunities. Why would this be the case?

Case Solved: Analysis Paralysis

My client was falling into the trap of focusing too much on what could go wrong with investments. He was over-analyzing risks, thinking of every possible thing that could possibly go wrong, no matter how unlikely it was to actually happen. This resulted in what’s sometimes called “analysis paralysis,” or over-thinking to the point that he missed out on solid investment opportunities. Now he is working on more effective risk analysis and management skills.

I should mention that if he had scored high in Risking and low in Analyzing Pitfalls, he would have had a different set of problems. People who score this way tend to jump the gun and make too many bad decisions because they have the opposite problem—they don’t spend enough time on risk analysis. In fact with my client, we found out that under stress he “flips” to becoming a too risking. Not a good combination for an investment banker!

Where do you think you fall in the Strategic paradox? Are you missing opportunities or taking to too much risk? Think about this the next time you have to make a decision. Paying attention and becoming more aware can help you become a better strategist.

Recent Posts

Recent Podcasts

- 10 Mar 2014Organizational Creativity

- 24 Feb 2014Interactive Learning Platforms

- 24 Feb 2014Civility in the Workplace

- 24 Feb 2014The Essence of Leadership

Contact Details

- 3463 Chastain Glen Lane

Marietta, GA 30066 - 678-761-3550

- info@theperformancedifference.com

- Contact Form

[…] are on Week Two of my four week series looking at some of the key leadership paradoxes. Click here to read last week’s blog in case you missed it. This week’s case is about the […]